The use of technology has assured us several positive changes in our daily activities, including obtaining your RFC.

Facilitating and optimizing our time in some way, in addition to some materials that can be silently replaced by mechanography.

Especially in the health conditions we have faced in recent years, technological advances have emerged as great allies in the quest to minimize all human contact.

We know that in the Mexican context, bureaucratic procedures can be extremely slow.

Above all, it takes an excessive amount of time.

But these procedures are extremely important and necessary, which is why all citizens are likely to be a waste of money and time.

As one of the main innovations in bureaucratic procedures in Mexico has been related to automobiles, it must be constantly updated.

Becoming one of the most important documents for every Mexican citizen is the RFC (Federal Taxpayer Registry).

This is only done until 2022 to people with income or work history.

But as of 2022 it has become something that all 18 year olds should get.

In this way, it is important to know it better and know how to process it.

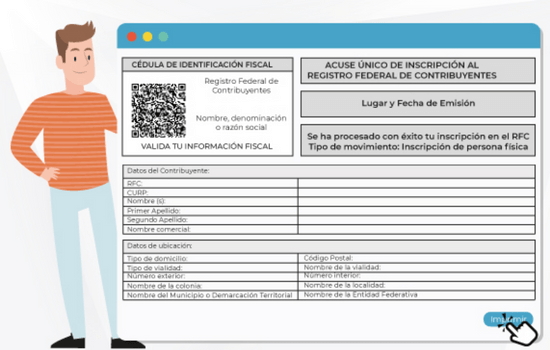

Therefore, the Mexican government has made available an online platform for people who want to demand or even consult the Federal Taxpayer Registry (RFC) for free from your mobile phone screen.

What is RFC?

It is no more than the Federal Taxpayer Registry, with an alphabetical key in which the registration and content of people in Mexico who work or receive some type of income is carried out.

As I said previously, from 2022 onwards it will not be necessary to be in one of the situations to count on the Federal Taxpayer Registry (RFC).

Therefore, any citizen over 18 years of age must demand it.

That is to say, the Tax Administrative Service (SAT) carries out all the control and surveillance of the economic activity of people in Mexico.

An important fact is that the alphanumeric key on the ground is provided to physical persons, but it will also be required that all legal persons register to be able to declare their income during the tax exercise and thus obtain control over their finances.

According to the basis of article 27 of the Federal Tax Code, be registered with the Servicio de Administración Tributaria (SAT) and contain the Federal Taxpayer Registry (RFC) is mandatory for physical and moral persons.

The first thing to do is request federal taxpayer registration.

You will be required to provide several important pieces of information in the federal taxpayer registry.

For example, identity, domicile, tax situation through the notices established in the Regulation of this code.

Always maintaining a single email, telephone number and contact methods determined by the tax authority.

Declare the domiciled tax in the federal taxpayer registry and request the advanced electronic signature.

Read also:

Express your skills as a painter with InColor.

How to take better care of the environment, understand.

Final considerations

The form of consultation of the Federal Taxpayers registry (RFC) it can be done via the internet through the official page of the Secretariat of Hacienda and Crédito Público, going to the specialized portal of the Servicio de Administración Tributaria (SAT) completely free of charge.